Financial Information

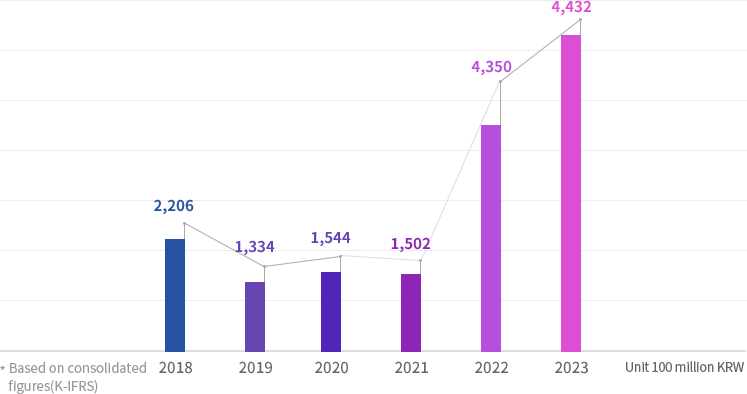

Revenue

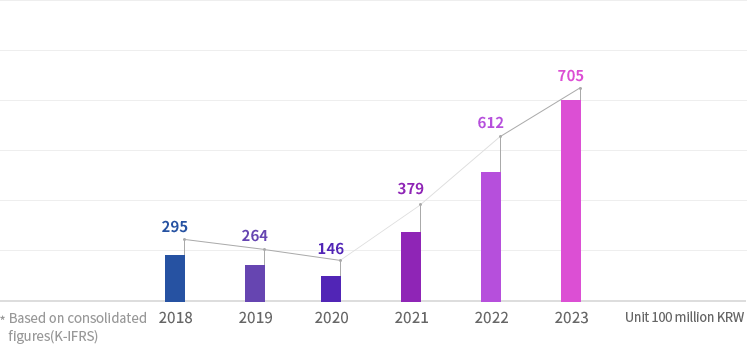

Operating Income

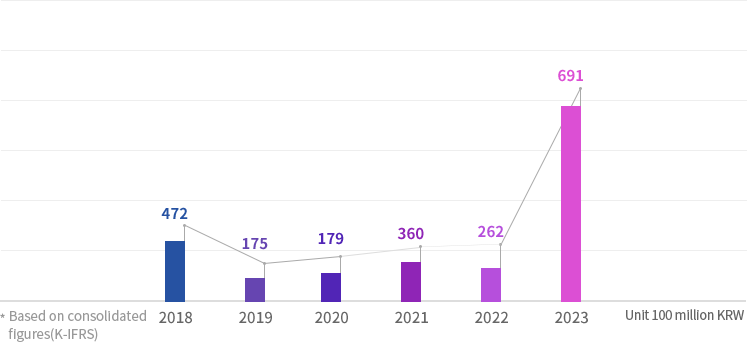

Net Income

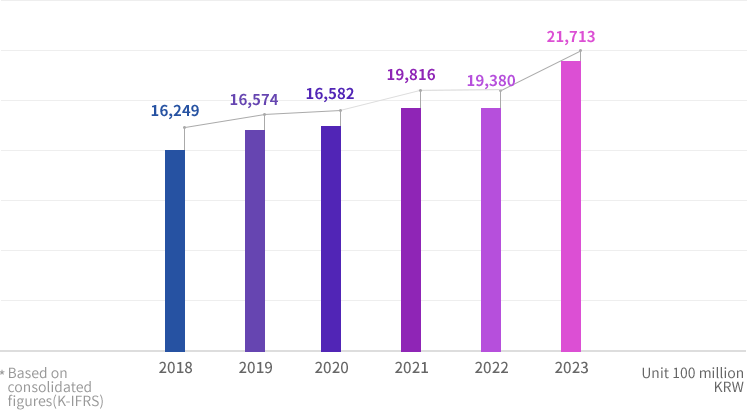

Total Assets

| Classification | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|---|

| Return on Equity | Net income attributable to owners of the Company / Average Equity attributable to owners of the Company |

4.4% | 1.8% | 1.8% | 4.3% | 1.5% | 4.8% |

| Debt Ratio | Total Liabilities / Total Equity | 7.2% | 8.4% | 7.9% | 14.4% | 11.6% | 14.2% |

| Equity Ratio | Total Equity / Total Assets | 93.3% | 92.2% | 92.7% | 87.4% | 89.6% | 87.5% |

| Return on Assets | Net Income / Average Total Assets | 3.8% | 1.1% | 1.1% | 2.0% | 1.3% | 3.4% |

| Revenue Growth Ratio | (Current Year-Previous Year)/Previous Year | 77.4% | 8.9% | 15.7% | -2.7% | 189.6% | 1.9% |

| Operating Profit Growth Ratio | (Current Year-Previous Year)/Previous Year | 169.1% | -0.3% | -44.4% | 158.9% | 61.5% | 15.3% |

*Based on consolidated figures(K-IFRS)

| Classification | 2018 | 2019 | |

|---|---|---|---|

| Return on Equity | Net income attributable to owners of the Company / Average Equity attributable to owners of the Company | 4.4% | 1.8% |

| Debt Ratio | Total Liabilities / Total Equity | 7.2% | 8.4% |

| Equity Ratio | Total Equity / Total Assets | 93.3% | 92.2% |

| Return on Assets | Net Income / Average Total Assets | 3.8% | 1.1% |

| Revenue Growth Ratio | (Current Year-Previous Year)/Previous Year | 77.4% | 8.9% |

| Operating Profit Growth Ratio | (Current Year-Previous Year)/Previous Year | 169.1% | -0.3% |

| Classification | 2020 | 2021 | |

|---|---|---|---|

| Return on Equity | Net income attributable to owners of the Company / Average Equity attributable to owners of the Company | 1.8% | 4.3% |

| Debt Ratio | Total Liabilities / Total Equity | 7.9% | 14.4% |

| Equity Ratio | Total Equity / Total Assets | 92.7% | 87.4% |

| Return on Assets | Net Income / Average Total Assets | 1.1% | 2.0% |

| Revenue Growth Ratio | (Current Year-Previous Year)/Previous Year | 15.7% | -2.7% |

| Operating Profit Growth Ratio | (Current Year-Previous Year)/Previous Year | -44.4% | 158.9% |

| Classification | 2022 | ||

|---|---|---|---|

| Return on Equity | Net income attributable to owners of the Company / Average Equity attributable to owners of the Company | 1.5% | |

| Debt Ratio | Total Liabilities / Total Equity | 11.6% | |

| Equity Ratio | Total Equity / Total Assets | 89.6% | |

| Return on Assets | Net Income / Average Total Assets | 1.3% | |

| Revenue Growth Ratio | (Current Year-Previous Year)/Previous Year | 189.6% | |

| Operating Profit Growth Ratio | (Current Year-Previous Year)/Previous Year | 61.5% | |

*Based on consolidated figures(K-IFRS)

*Based on consolidated figures(K-IFRS)

※ P&L in FY19 has been revised due to the disposal of BGF Humannet stake and the decision to dispose of Southsprings stake.

Please refer to the audit report for details.